U.S. Toy Industry Mid-Year Sales Grow Over 7 Percent, Tracking Ahead of 2015 Growth Rates,

The NPD Group Reports

The following press release was issued by The NPD Group on Monday, July 25, 2016.

July 25, 2016 | The U.S. toy industry grew 7.5 percent in the first half of 2016, outpacing last year’s mid-year and annual growth rates*, according to global information company The NPD Group. NPD estimates that the industry will grow approximately 7 percent, or $1.4 billion, for full-year 2016.

“I expect to see continued growth for the U.S. toy industry for the remainder of 2016 and, if it reaches 7 percent for year-end, that would be the fastest growth of the U.S. toy market since 1999,” said Juli Lennett, senior vice president, U.S. toys industry analyst, The NPD Group. “Toys with movie tie-ins will continue to contribute to the increase, stemming from those released both in 2015 and 2016. Television, over-the-top and other content providers, like YouTube and social media, will also continue to drive growth.”

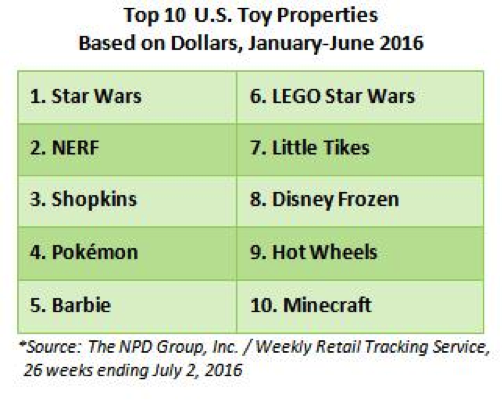

Star Wars was the biggest contributor to the industry’s mid-year growth, with dollar sales for Star Wars toys increasing nearly 200 percent through June. “Star Wars is already at $300 million for the year, compared to $700 million for all of 2015. With two-thirds of toy sales yet to come in 2016, Star Wars could be even bigger this year than last,” added Lennett.

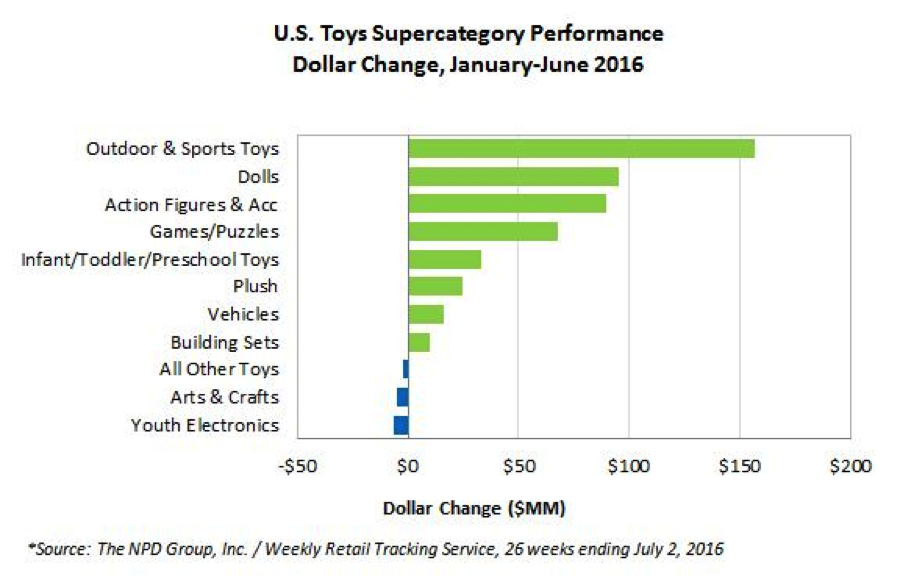

Looking at sales by supercategory, Outdoor & Sports Toys was not only the largest with $1.7 billion in sales, but also the hottest category and another top reason for industry growth so far this year. Last year, at this time, Outdoor & Sports grew the most of any supercategory and, this year, that growth nearly doubled to represent 32 percent of total toy industry growth for the year so far. Overall, eight of the 11 supercategories posted gains during the first half of 2016, with Action Figures and Dolls the two to grow the fastest, at 19 percent and 14 percent, respectively.

“I believe some of this explosion in Outdoor & Sports is a result of Millennials seeking a healthier, outdoor lifestyle for their kids, as well as looking for more laugh-out-loud experiences with play, minus the rules and directions,” said Lennett. “I will be interested to see what new toys will help kids create this type of experience during the fall and winter months.”

*Source: The NPD Group, Inc. / Weekly Retail Tracking Service, 26 weeks ending July 2, 2016

Data is representative of retailers that participate in The NPD Group's Retail Tracking Service. NPD’s current estimate is that the Retail Tracking Service represents approximately 80 percent of the U.S. retail market for Toys.